Keeping Overseas Income Organised And Accurate

If you receive dividends or interest from outside the UK, you’ll need to add this to your Pie App so your tax overview stays up to date. Foreign income can feel a bit complicated, but adding it in Pie only takes a few taps.

Your Step-by-Step Guide

Foreign income includes any payments you receive from overseas sources such as dividends from a non-UK company, interest from an international bank account, or other investment income paid outside the UK. Pie keeps everything simple by letting you record this under Dividends / Interest.

Here’s the quickest way to do it

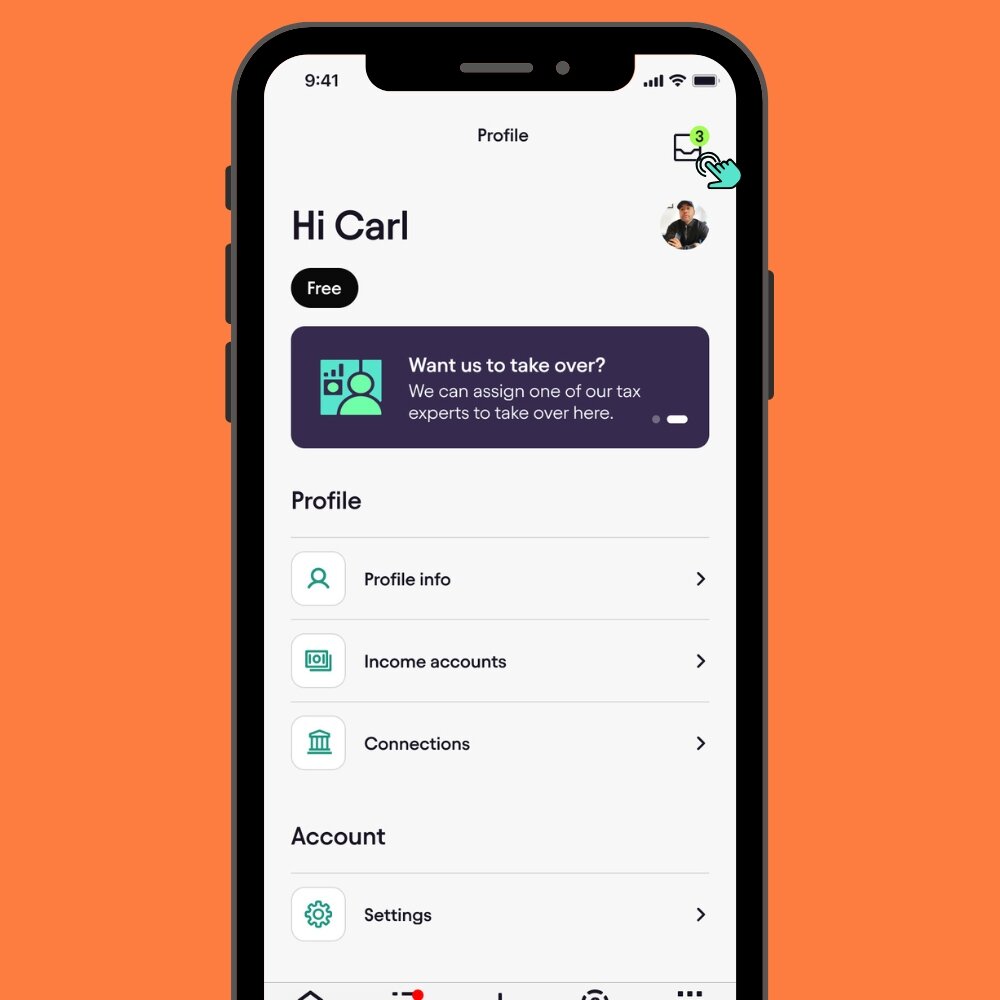

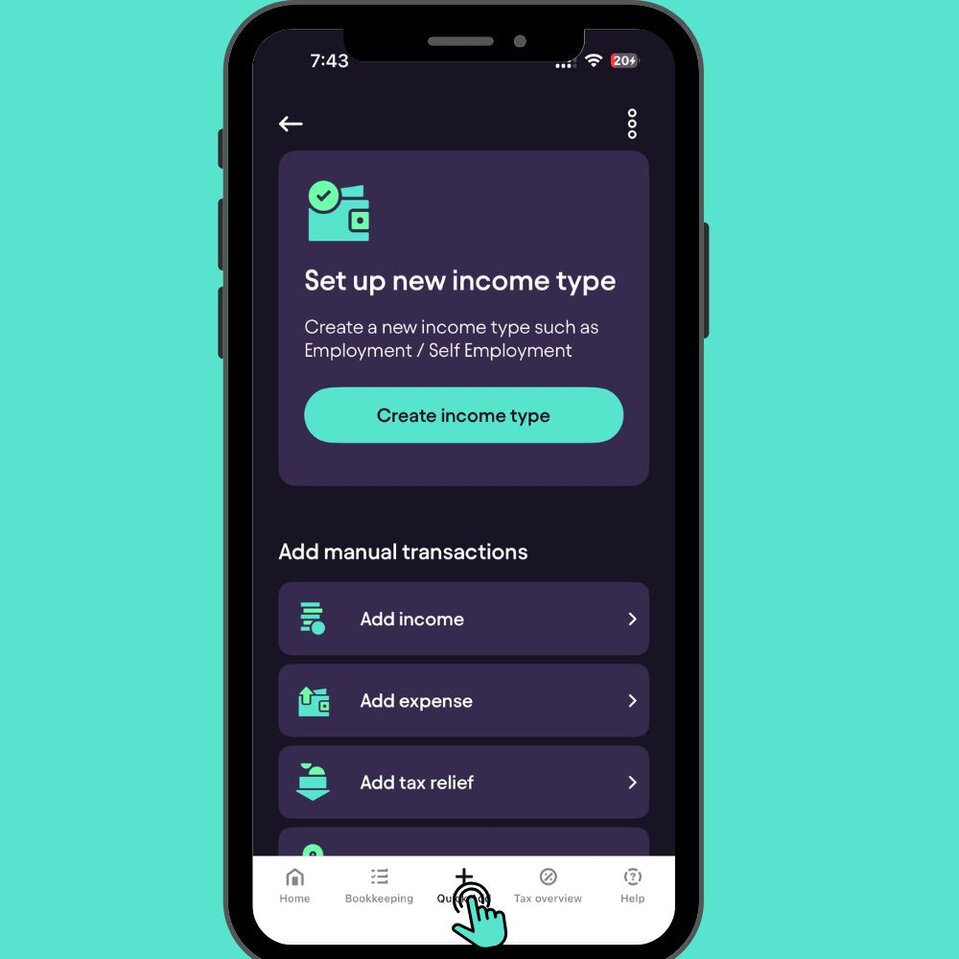

Launch the Pie Tax App on your device. Once the app is open, tap the avatar icon located in the top left corner of the screen to access your profile. Open the Pie App and go to Quick Add

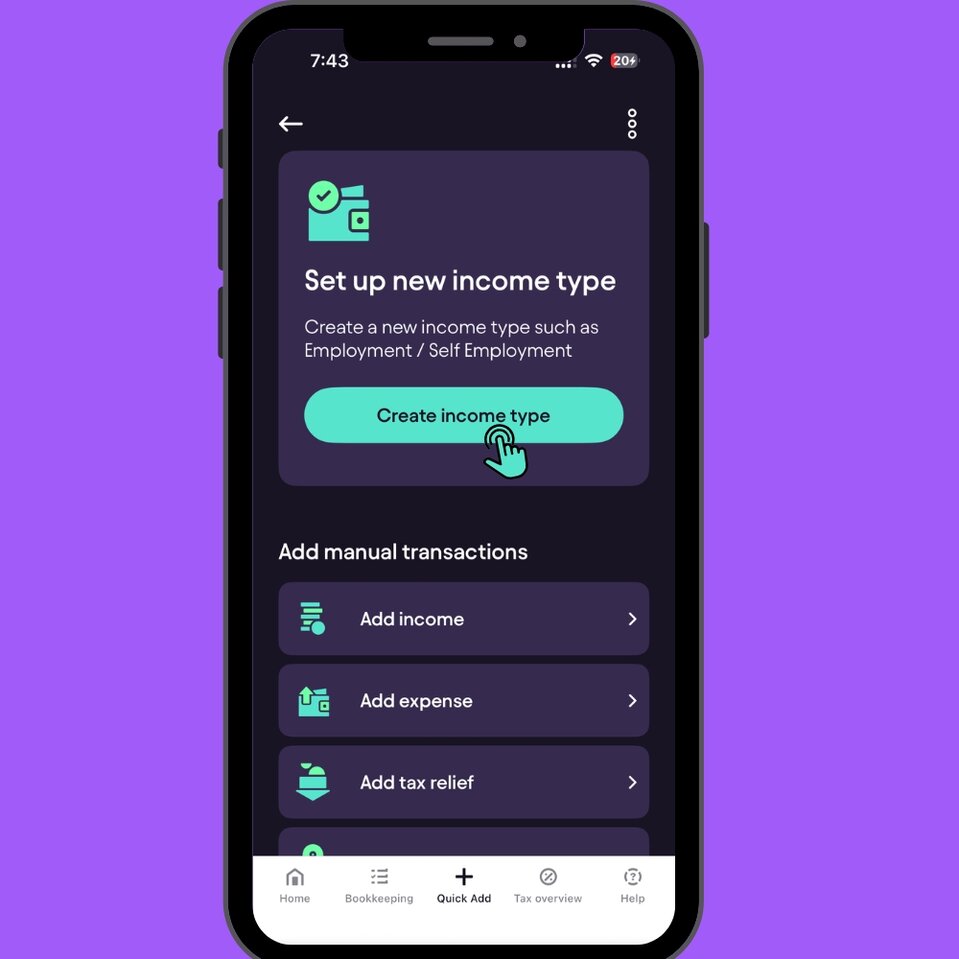

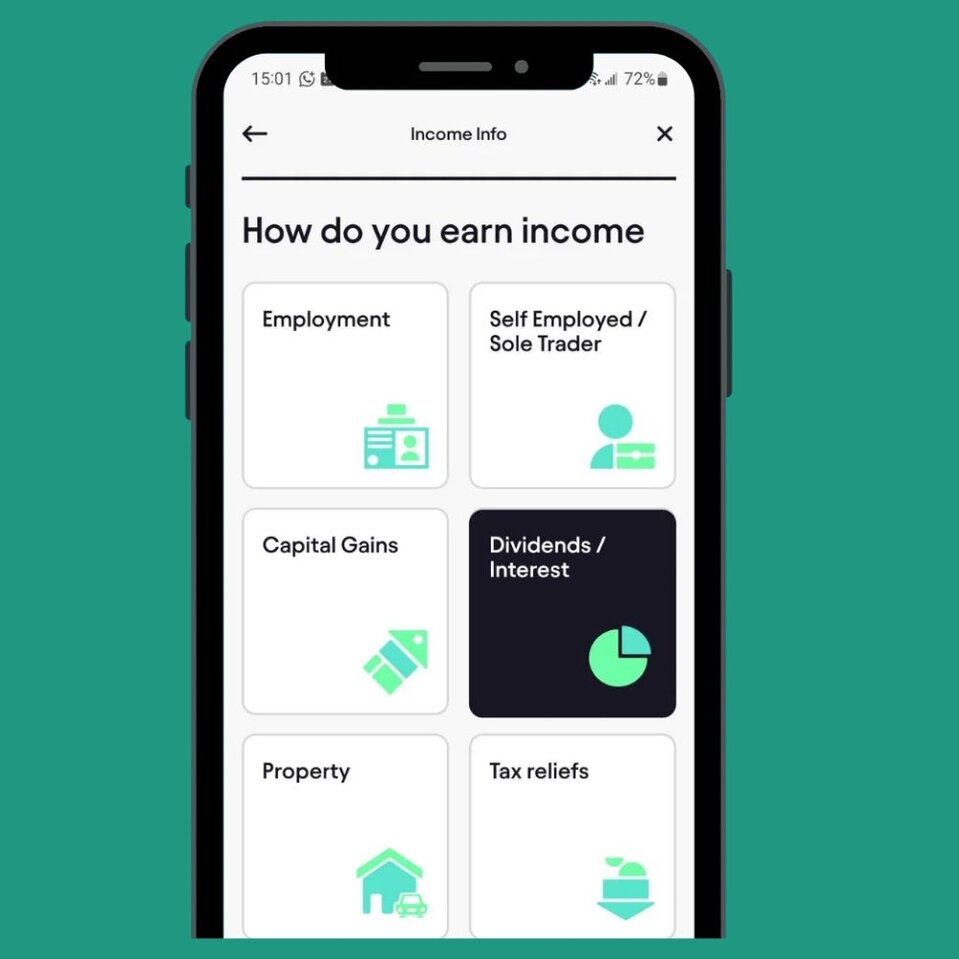

After clicking on Quick add, Choose 'Create income type' to add Foreign Income in the Pie app.Choose “Create Income Type”

This is where all UK and foreign investment income is added. This opens the list of income types you can manually enter.Select “Dividends / Interest”

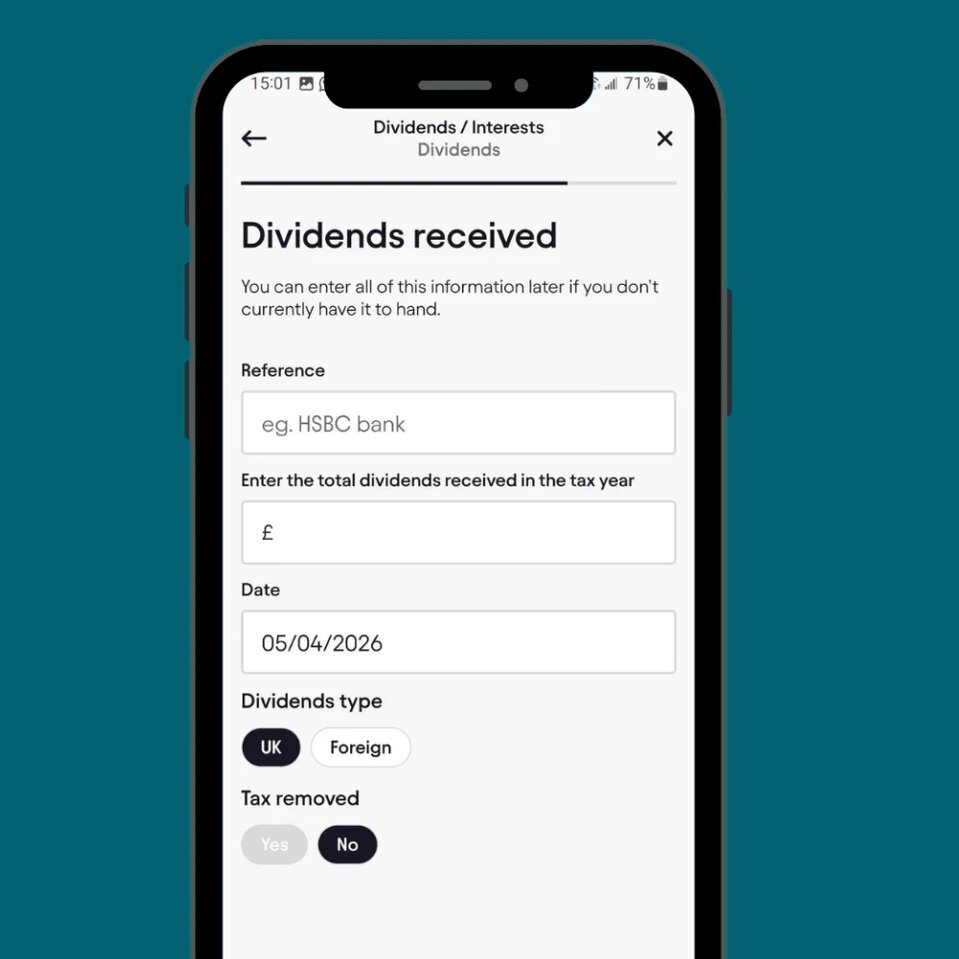

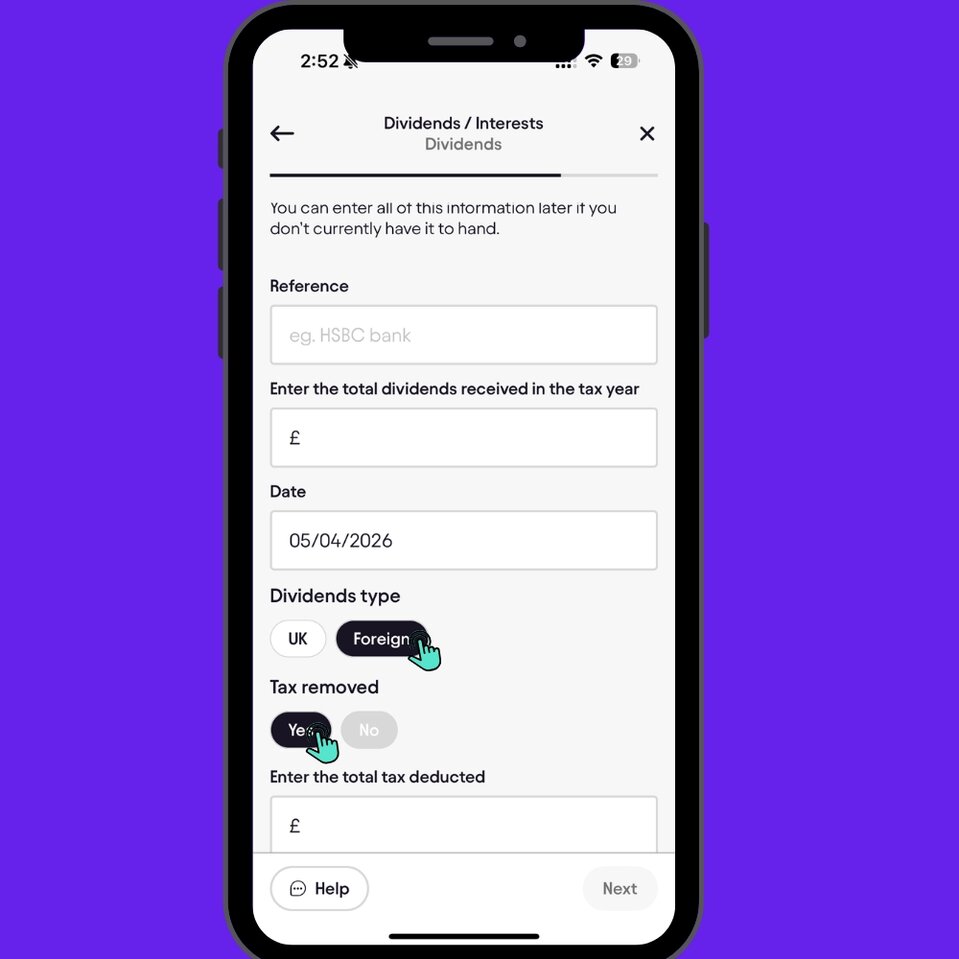

Add your reference (such as the bank or company name), the total amount you received, and the date it was paid.Enter your income details

Switching to Foreign tells Pie this income was earned outside the UK so the right tax rules are applied. Also, confirm if tax was removed overseas, select Yes and enter the amount. If not, select No.Change the income type to “Foreign”

Additional step if your foreign income is over £2,000

If the total amount of foreign income you received exceeds £2,000, we’ll need to take a closer look to make sure everything is filed correctly.

Just head to the Message Centre in your Pie App and send us a quick message our team will guide you through the next steps.

Here’s the quickest way to do it

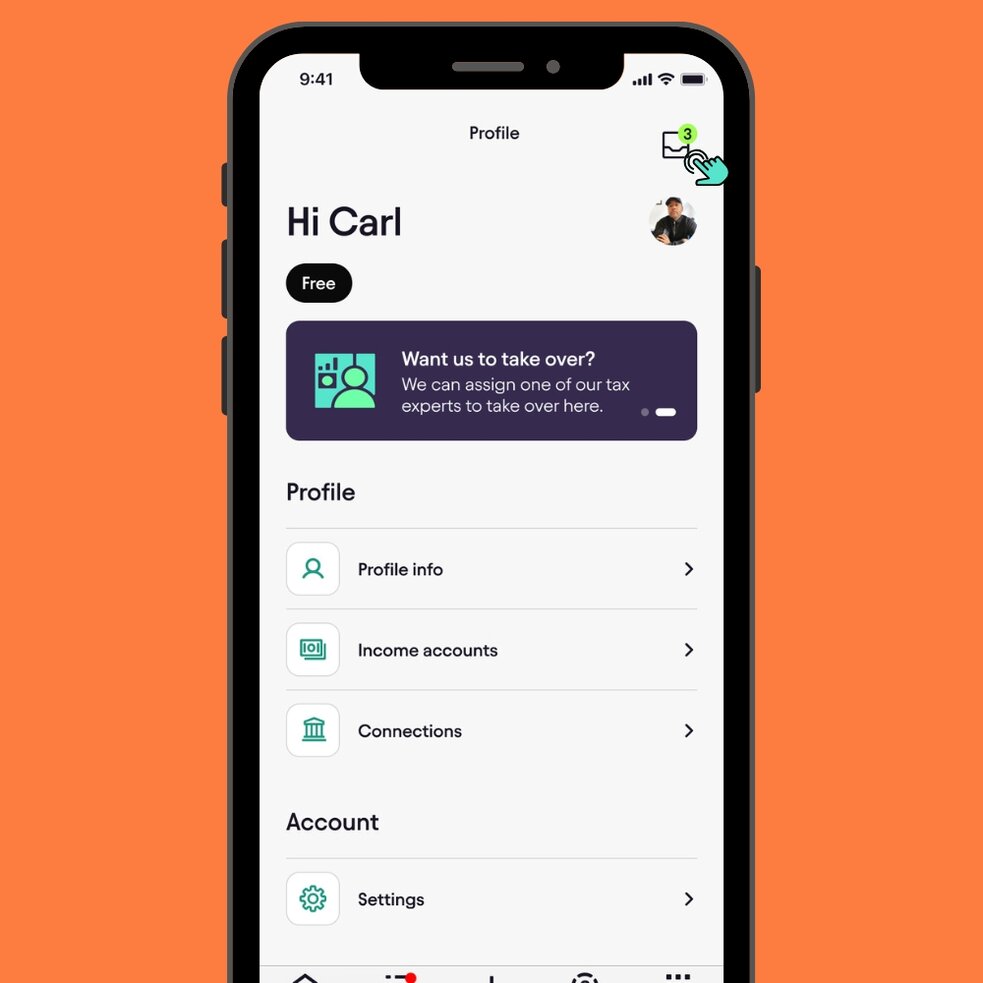

Launch the Pie Tax App on your device. Once the app is open, tap the avatar icon located in the top left corner of the screen to access your profile.Open the App and Access Your Profile

In the profile section, at the top right corner, Click on chat icon to start support chat with Pie AssistantGet Support from Pie Tax Assistant

Why it matters

Adding your foreign income helps Pie calculate your tax accurately and ensures nothing is overlooked when it’s time to file your return. It keeps everything in one place simple, clear, and stress-free.

Summary

Adding foreign income in Pie is quick and straightforward. Just go to Quick Add, choose Add income, select Dividends / Interest, switch the type to Foreign, and save your details. Pie updates your tax overview instantly so you always know where you stand.