Changes to property taxation announced by Chancellor Rachel Reeves in the most recent Budget are likely to put upward pressure on UK rents and could further restrict the supply of rental homes, according to Britain’s largest building society. The warning comes amid fresh data showing a slowdown in house price growth at the end of 2025.

Nationwide’s chief economist has flagged particular risks for the buy-to-let sector, suggesting that higher taxes may deter new landlords and influence affordability for tenants.

These shifts are set against a complex backdrop of subdued consumer confidence and high mortgage rates, with the market now closely watching the year ahead.

Overview of recent property tax changes

The November 2025 Budget introduced several property-related tax measures aimed at generating additional revenue and addressing housing market imbalances. Among the changes is an increase in taxes on rental property income, which is intended to take effect from April 2026.

A new council tax surcharge on high-value properties is also planned, though it will not be implemented until April 2028 and is expected to affect less than 1% of homes in England and approximately 3% in London.

These measures are the latest in a series of policy shifts targeting property investors and high-value assets. Government ministers have stated the aim is to improve fiscal sustainability while targeting perceived inequities in property taxation.

Nationwide’s outlook on rental market pressures

Nationwide has expressed concern that the planned tax increases could have indirect effects on the private rented sector. Chief economist Robert Gardner stated,

“The increase in taxes on income from properties may dampen buy-to-let activity further and hold down the supply of new rental properties coming onto the market, which could, in turn, maintain some upward pressure on private rental growth.”

Nationwide’s analysis suggests that while the immediate impact of high-value surcharges will be limited due to their narrow scope and delayed introduction, broader tax rises risk exacerbating pressures on tenants by constraining supply and driving up rents.

Analysis of recent house price trends

Data from Nationwide show that UK house prices declined by 0.4% in December 2025 compared to the previous month. Annual house price growth also slowed, falling from 1.8% in November to 0.6% in December the lowest year-on-year increase since April 2024.

Nationwide attributed part of the annual slowdown to a strong comparison period in December 2024, when year-on-year house price growth reached 4.7%. Despite this recent moderation, broader price levels remain above pre-pandemic norms.

Implications for the buy-to-let sector

The tax changes arrive at a challenging moment for private landlords, especially those relying on rental income as mortgage costs remain elevated. The tighter tax regime may further disincentivise investment in new rental properties, as reduced after-tax returns prompt some landlords to exit the market or scale back planned purchases.

Trade bodies have cautioned that, without countervailing support or reforms, these fiscal measures could intensify existing supply constraints in the rental sector. This could leave tenants facing stiffer competition for fewer available homes.

Consumer sentiment and mortgage trends

Consumer confidence remained subdued in late 2025, with many households wary of major financial commitments amid economic uncertainty and relatively high borrowing costs.

According to Nationwide, average mortgage rates remain around three times higher than their post-pandemic lows, constraining affordability for both owner-occupiers and investors.

However, Gardner noted that, despite these challenges, mortgage approvals in 2025 were close to pre-pandemic levels. This reflects a degree of resilience in demand, albeit within an overall cautious environment.

Final Summary

Recent tax reforms targeting property income and high-value assets are expected to create headwinds for the UK’s private rented sector through 2026.

While measures such as the council tax surcharge will reach only a narrow segment, broader tax rises could deter new investment and reduce rental supply at a time when demand remains strong. Combined with slower house price growth and persistent affordability challenges, the outlook suggests further pressures for tenants and landlords alike.

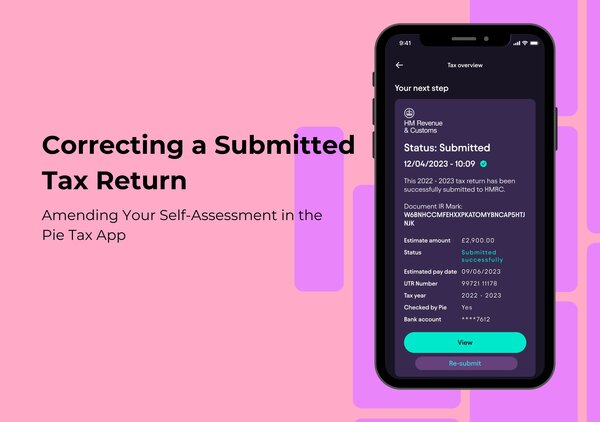

For those managing property portfolios or planning investment decisions, ongoing monitoring of fiscal and market developments is essential. Stay informed on these market changes through timely financial reporting and dedicated tools available in the Pie app.